Link to

The BidPro Parameter Sheet sets your companies specific information:

Link to |

|

The BidPro Parameter Sheet sets your companies specific information: |

sales

tax rates |

||

subcontractor rates |

||

licenses, premiums, prevailing wage |

||

markups for material & labor |

||

raw

pay rates. |

This sheet incorporates numerous YES/NO toggle switches to help you decide how the proposal will be calculated. If, for example, you do not want BidPro to incorporate Prevailing Wage calculations, simply input an N for NO in the appropriate box of the Parameter Sheet and it will not be utilized.

• Site surveys always give the estimator a better insight into the project.

This information allows management to ascertain how much confidence to place

in project costs and possible unforeseen pitfalls. The Site Survey Completed?

toggle is set to NO. This same information is placed on the Margins Sheet for

evaluation. After a survey is complete, reset the toggle switches to Y or YES

(upper/lower case does not matter) and the appropriate information will be changed

downstream.

Figure 1 Site Survey Toggle

Site

Survey Completed ?

|

NO

|

The Margins Sheet of

BidPro will display Figure 2.

Figure 2 Cascade Results

Site Survey was

not done ! |

•The Preliminary Bid toggle switch is set to Y (YES) so approval signatures can be obtained. When this toggle is set to N (NO), the FINAL BID APPROVAL signature box will appear in the headers. This is not a crucial input factor but it can aid in providing version control of this bid.

Figure 3 Preliminary Bid Toggle Yes

| Preliminary Bid Approved: _____________ Date: _______ | |

Preliminary Bid ? |

yes |

The YES response indicates this project is a Preliminary Bid, and as such may be changed further. Signature level may be different than Final.

Figure 4 Preliminary Bid Toggle No

| Final Bid Approved: _____________ Date: _______ | |

Preliminary Bid ? |

no |

The NO response to this Preliminary Bid will yield the Final Bid Approval form. Higher signature authority may be required to obligate the company.

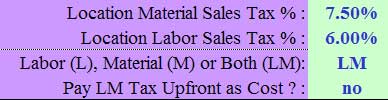

• Set

the Location Material Sales Tax Percent to the appropriate value for your

area (i.e.,

.085 will

be displayed as 8.5%, .0775 will display 7.75%).

Some states only charge sales tax on material, while others charge tax on

both material and labor. By telling BidPro your specific requirements, the

correct tax will be calculated. Note, both material and labor sales tax (the

LM option) can be calculated at different rates for regional flexibility.

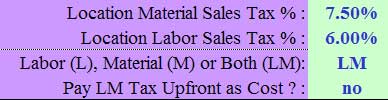

Figure 5 Material Tax Rate

Some contractors pay all project material (and/or labor) costs and tax upfront and charge the customer a flat price. Since this impacts the bottom-line cost, a Y/N toggle switch is available to indicate if this tax cost is treated as an upfront cost.

Figure 6 Material Tax Rate that will be charged upfront as a cost

The next item depicts using both material tax (8%) and labor tax (6%) but not paid upfront as cost.

Figure 7 Labor Tax Rate (if applicable)

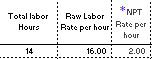

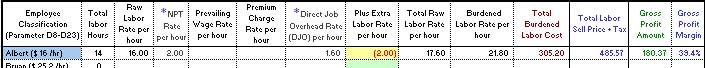

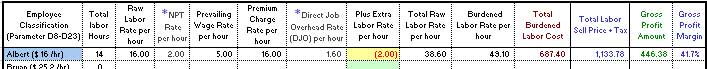

• Non-Productive time is available to incorporate the time a technician is on site waiting for other trades, comebacks, meetings etc. The Non-Productive time is the total number of hours per day counted on to complete the task but is really not available. To account for this lost time, BidPro incorporates an add-on charge per hour to the technician base rate. Since most teams break at the same time and the same duration, this information is converted to an average cost/hour that is added to all technician hourly rates. Note: if not all workers are subject to this added cost, remove the desired hourly dollar amount from the Summary Sheet labor section labeled Plus Extra Cost Per Hour as a negative number (i.e., -2.00 will remove $2.00 per hour from that wage calculation.

Figure 8 Non-productive Labor

![]()

Each

8-hour day will result in 7 hours productive and 1 hour non-productive.

So if a task is planned at 14 hours, it would stand to reason that this task

should take 16 hours. But since we do not want to change the estimated

task hours, we will assume that task to cost an equivalent 16 hours at

a specific pay rate. *Note:

the Non-productive Time has a zero percent markup associated with this amount. This

means that a markup for this non-productive time is not passed on to the

customer.

The Summary Sheet will reflect 14 total labor hours at $16.00 raw pay

plus $2.00 per hour of non-productive time:

Figure 9 NPT Cascade

Removing non-productive hourly rate for a specific employee on Summary Sheet simply place -$2.00 on the green - Plus Extra Labor Cost/hour line. Note green area will turn yellow when a negative number is encountered.

Figure 10 Subtracting Extra Labor Rate

Example

1: Technicians that smoke typically stop every two hours for a 15-minute “cigarette

break” (arggghhh). This would equate to 1-hour non-productive time

per day (8 hour workday divided by a break every two hours equals 4 breaks

per

day

@

15 minutes each =1 hour). If the labor rate of that technician were $16.00

per hour, then the labor rate would be increased by $2.00 per hour.

Example 2: The General Contractor (GC) regularly holds operational meetings

that are scheduled for 1/2 hour every day. Even though you have accounted

for this time, these meetings invariably go to 1 hour per day. The Non-Productive

Time equals 0.5 hour per day (length of meeting above the scheduled ½ hour).

If the labor rate per hour were $16.00, then the technician labor rate would

be increased by $1.00 per hour.

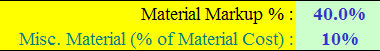

• Miscellaneous Material is a percent of the Total Material Cost to account for cable hangers, zip ties, setup, ceiling tile damage, oversight, etc. The industry average miscellaneous material cost is 10% of the total material cost. This amount is preset in BidPro but the user can adjust this value accordingly.

Figure 11 Miscellaneous Toggle

| Misc. Material (% of Material Total) : | 10% |

• Freight percentage is calculated from the Total Material Cost (with Misc. included) to account for shipping handling, warehousing and pickup. The industry average freight cost is 5 % of the total material cost. This amount is preset in BidPro but the user can adjust this value accordingly. The markup is at the Material Markup Percent (%).

Figure 12 Freight Toggle

| Freight % (average 5%) : | 3% |

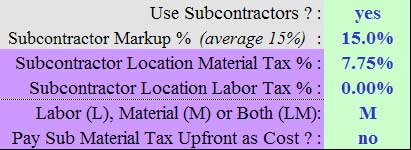

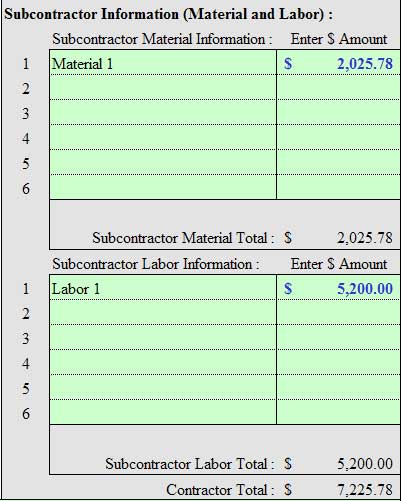

• In order to use the Subcontractor

Material and Labor Cost box in the lower right corner of the Parameter

Sheet, the Subcontracts toggle switch

should be Y or YES.

Setting the Parameter Sheet Subcontracts Figure 13 to “Yes”,

opens the Subcontractor Material and Labor section for inclusion:

Figure 13 Subcontractor Toggle =Yes

Figure 14 Sub Toggle Yes

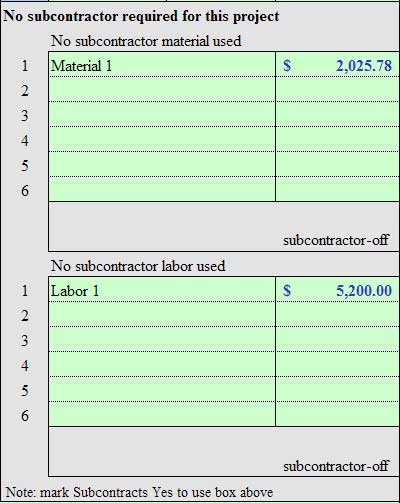

If the “Use contractor” box is checked N for NO, the values (Figure 16) in those boxes will not be used in any calculation even though there is information and pricing available. The same regional sales tax situation applies here also. As an example, in San Diego, CA we are only able to charge the customer for sales tax on the contractor supplied material, not on the contractor’s labor. The Subcontract Markup % (percent) is the markup on the subcontractor supplied material and labor.

Figure 15 Sub Toggle =No

![]()

Figure 16 Sub Toggle "NO" Results

Although input has been made on the Subcontract Section, the total dollar amounts are not calculated since the Y/N toggle switch had been set to NO contractors.

The Subcontractor material and labor taxes are calculated similar to the project material and labor. By signifying which item is taxed at which rate, BidPro will automatically generate the correct values in the Margins Sheet.

• License/Permits – based on the Material Markup %, licenses and permits are calculated on the Summary Sheet. In this example a dollar value is entered, but the Y/N toggle is set to NO so the $250.00 cost will not be used to calculate a sell price for the License/Permits.

Figure 17 License/Permit Toggle

| License/Permit : | yes |

| License/Permit Cost in dollars : | $250.00 |

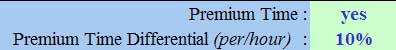

•Premium Time – shift differential (Union Contracts or weekend rates) is based on the raw labor rate and uses the labor markup. Since the Y/N toggle is “no”, there is 0 value.

Figure 18 Premium Time Toggle

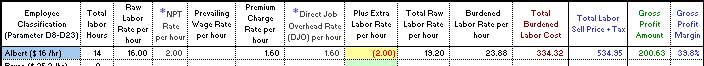

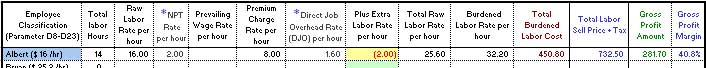

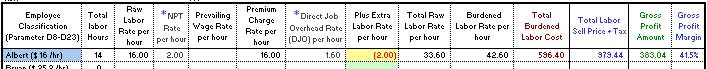

If the user makes premium time (shift differential) a Yes, Figure 19, the value is automatically input into the Labor Calculations on the Summary Sheet. In this case, the 10% adds $1.60 to the $16.00 Base Raw labor rate of Albert. A fifty percent (50%) Premium Time could be indicative of time-and-one half ($24/hr), 100% for double time ($32/hr) if weekend work rates are stipulated in the proposal.

Figure 19 Premium Time Toggle = YES for 10%

Figure 20 Premium Time Toggle = YES for 50% for Time-and-one half rate

Figure 21 Premium Time Toggle = YES for 100% for Double Time

• Prevailing Wage – based on the Labor Markup %, is calculated on the Summary Sheet. The dollar amount input here will increase the base rate of pay of every worker specified in the Labor Sheet. Hence, a $16.00 per hour worker pay rate will automatically be charged at $21.60 per hour if the Prevailing Wage Y/N switch is set to YES.

Figure 22 Prevailing Wage Toggle

| Prevailing Wage : | yes |

| Prevailing Wage (add/hour) : | $5.00 |

Figure 23 Prevailing Wage Toggle toggle set to YES for $5.00 per Hours would result in the following $27.78 Total Burden Labor Rate or $388.92 cost.

• Parking - based on the Material Markup %, is calculated on the Summary Sheet. The total job length, based on: the Desired Work Day length, Desired Hours Worked per Day and total job hours are used to calculate the number of days the specified technicians get parking. The number of days can be user adjusted and the number of technicians getting the parking fees are set on the Parameter Sheet. Note, fractional parking days are rounded to the next day (i.e., 3.4 will become 4 days).

Figure 24 Parking Toggle

| Paid Parking : | yes |

| # Crew Members Paying Parking : | 2 |

| Parking $ Cost/Day/Crew Member : | $5.00 |

Therefore, a crew size of 4 (Summary Sheet) will take the project 10 days to complete. The total cost of parking will be $155.00 and the sell price is $217.00 for a $62.00 profit @ 28.6 GMP.

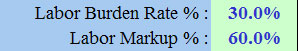

• Burden Rate % – based on company calculated internal employee cost rate (typically 30%). This value, in addition to the Labor, Material Markup, and Direct Job Overhead percent, is used to calculate the Gross Labor Rate per Hour on the Summary Sheet.

Figure 25 Labor Burden Rate

![]()

• Labor Markup % – set value, 60%, or as needed to get the Summary Sheet Labor Total Gross Margin percent to your targeted financial goal or objective.

Figure 26 Labor Markup Rate

• Material Markup % – set value, 60%, or as needed to get the Summary Sheet Material Total Gross Margin percent to your targeted financial goal or objective.

Figure 27 Material Markup Rate, plus 10% Misc. Material

• Direct Job Overhead (DJO) – set value per your Profit Plan according to your specific location. This value will calculate the Labor Direct Overhead of the Raw Labor Cost only before markup and will be displayed on the Summary Sheet

Figure 28 DJO Rate

![]()

*Note: the DJO has a zero percent markup associated with this amount.

+Note: the DJO is equal to total labor cost times markup percent

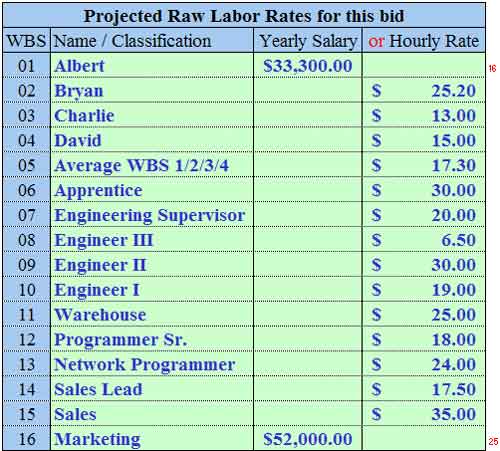

• The Labor Rates

(upper right of Parameter Sheet) are used as input to the Labor Sheet.

The WBS (work breakdown structure is set from 1 to 16. This

could depict 16 employees, or work classifications. The user can set pay

ranges and specific pay for this project. However, This Bid Raw $ value

is used in the calculations.

Parameter Sheet input:

Figure 29 Employee Classifications

•Parameter Sheet Column AC, Rows 1, 2, 3 and 5 can be used to personalize each sheet for printing purposes. The baseline GPM is set here and utilized on Section 5 of the Margins Sheet.

Figure 30 Company Name & Phone

| your telephone number | 1-800-123-45678 |

| your company name | Your Company Name Here |

| desired gross margin % | 30% |

confirmed - set to: |

30% |

This section will help in printing other sheets with your specific company information. The company name and telephone number will print on every sheet to keep the proposal personalized. The desired gross margin % is the baseline for your business and will be utilized on the Margins Sheet and on optional TrakPro software.